Nykaa- A lesson in Vertical Commerce

Company Overview

FSN E-commerce Ventures Ltd or Nykaa is a digitally native consumer technology omni-channel platform across beauty and fashion categories. The company is primarily e-commerce led with foray into EBOs.

Industry

The Indian retail industry is approximately at INR 100 trillion growing at the rate of 5% CAGR. Fashion and beauty account for 35% ( INR 10 trillion) of the discretionary retail space (excluding pharma, food and grocery) with Fashion at INR 8 trillion and BPC at INR 2 trillion. Online penetration for fashion is ~12% while BPC is at 8%. Both the industries are continuing to grow at a CAGR of >10% in the online space.

Key Trends in online BPC

Trust is a key factor in this industry and online vertical players which specialise in this space are preferred. The trust is built by existing players investing in content commerce and aligning with relevant influencers.

Omnichannel model for BPC is also important as supplementing the online platform with an offline presence increases customer trust and improves the experience.

Key Trends in the online fashion industry`

GenZ segment: Consumers in the age bracket of 18-30 are increasingly buying fashion online while experimenting with new trends and unique styles`

Penetration in Tier 2 and below cities with the help of value fashion relevant players like Meesho has been significantly higher in the last couple of years

Business Model and Operations

Nykaa offers consumers an omnichannel experience for both beauty and fashion. This is due to their understanding of the consumer journey across each touchpoints and the ability to cater to the convenience of customers across.

Current Apps and Presence

Nykaa app and website for beauty and HPC

Nykaa fashion app and website for apparel, footwear and accessories along with NykaaMan for similar offerings for men

Offline stores: 221 total stores (9% GMV contribution) across 73 cities

Business Segments

Nykaa operates in Beauty and Personal Care (75% GMV contribution) and fashion (25% contribution). Offline stores contribute 9% of overall GMV while eB2B marketplace contributes ~5%. In terms of operating model, Nykaa's retail segment is driven by private labels (20% of overall GMV) and inventory model where it buys from brands and stores in its own and 3P warehouses.

In BPC, color cosmetics which comprises of makeup is the largest category followed by skincare, haircare, personal care, fragrances, devices and others. There are ~300K SKUs across ~4000 brands.

In fashion, Nykaa houses 4000 brands across curated selection of apparel (highest contribution to GMV) followed by bags, footwear and accessories

**Competitive Dynamics

In online BPC, it commands a strong 30% market share while in fashion, it has a 4% share in online.

- Horizontal E-Commerce Players:

- Beauty : Amazon and Flipkart are the major players in this segment

- Fashion: Amazon, Flipkart are key horizontals

- Vertical Players:

- Beauty: Purple, Tira Beauty are the major vertical players

- Fashion: Myntra, AJIO in the premium segment while Meesho, Shopsy are the major vertical players in the value segment

Business Opportunities and Growth Strategies

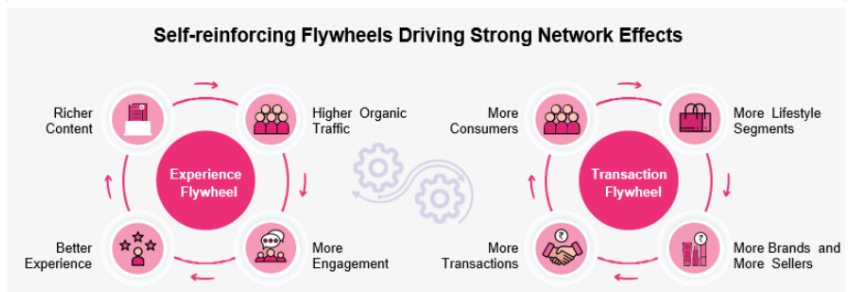

Nykaa believes that to become the preferred destination for beauty, luxury beauty and fashion/lifestyle- it needs to follow a flywheel approach similar to Amazon with the addition of the content and experience flywheel which accelerates its transaction flywheel.

Their growth strategy can be summarized as

- Increasing rate of new customer acquisition while building customer loyalty

- Strengthen brand relationships on the back of building a great brand image once it partners through its online/offline models

- Grow its own private label - House of Nykaa similar to how Amazon has grown its private labels- Amazon Basics

- Key geographical expansion and joint ventures

Financials

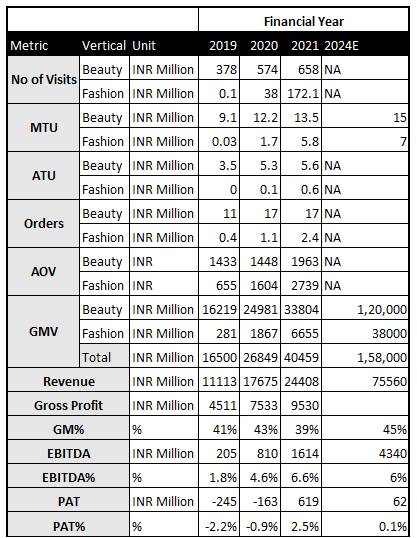

Nykaa has continuously improved its GMV (10x since 2019) while improving on its EBITDA% (+420 bps since 2019).

GM% improvements: led by incremental ad income and higher share of premium and featured brands .

EBITDA% improvements: led by improved fulfilment cost% due to moving to own warehouses from 3P and reduction in packaging cost and freight costs cost and freight costs

Management

- Nykaa is promoted by the Nayar family - Sanjay Nayar, Falguni Nayar and their two children - Anchit Nayar and Adwaita Nayar. Together the family owns about 54.25% of the entire company.

- Sanjay Nayar is the Chairman and CEO of the Indian arm of the private equity giant, KKR.

- Falguni Nayar was the Managing Director at Kotak Mahindra Investment Banking, leading the team that took various companies public.

- Anchit Nayar was a Vice President at Morgan Stanley Equity Research and Adwaita Nayar has worked with several consulting and investment banking giants.

Out of four, three members of the family work with Nykaa full time.

Technology

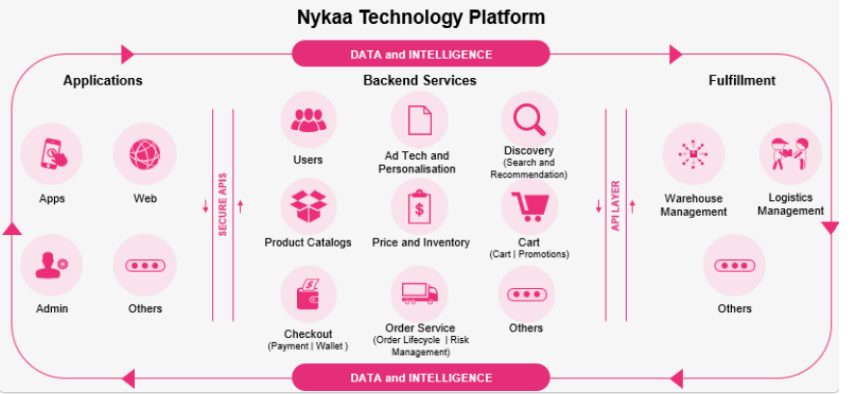

Nykaa platform follows a service oriented architecture approach with applications, backend services, data and security and is a proprietary, custom built and component based.

Positives

- Nykaa believes that every customer has a unique personal journey and hence likes to keep all their experiences separate - beauty, fashion, Men

- They invest heavily into building the brand trust through their content creation and knowledge sharing initiatives with the help of digital influencers and social media

- Nykaa controls its overall trust factor with the help of inventory model which enables them to have curated selection and control quality

Risks

- Although quoted everywhere as a risk in any e-commerce model, regulations have stabilized with regards to red flags around owning private labels while operating an inventory led marketplace platform.

- Increased competition from larger players through specialized beauty marketplaces like Tira Beauty, Myntra Beauty

Disclaimer: The information provided in this article is for informational purposes only and should not be construed as investment advice. The analysis and insights presented are based on publicly available information but we cannot guarantee the completeness or reliability of the information.